Navigating the Globe of Hard Money Loans: A Comprehensive Overview

Starting the journey of discovering difficult cash finances can be a difficult task for those unknown with this alternate kind of lending. The world of difficult money finances supplies distinct possibilities for people seeking fast access to resources, yet it likewise features its very own set of intricacies and considerations. As borrowers browse with the intricacies of difficult cash financing, recognizing the fundamentals, considering the advantages and downsides, and understanding the application process are critical steps in making enlightened financial decisions. The path to effectively safeguarding a hard money funding entails more than just these initial steps. Remain tuned to reveal necessary understandings on eligibility requirements, choosing the ideal lending institution, and important suggestions to improve your loaning experience in the world of tough cash lendings.

Comprehending Hard Money Loans

Recognizing Tough Cash Car loans requires a meticulous examination of the one-of-a-kind attributes and dynamics of this alternative funding choice in realty. Hard cash fundings are asset-based finances that are safeguarded by actual property, making them a preferred selection genuine estate investors looking for quick funding with less focus on credit reliability. Unlike typical small business loan, difficult cash finances are funded by exclusive financiers or companies, enabling even more versatility in terms and authorization processes.

One trick function of tough money loans is their quick approval and financing timeline, generally varying from a few days to a pair of weeks. This quick turnaround is valuable for financiers aiming to safeguard residential properties in open markets or those looking for urgent financing (georgia hard money loans). In addition, tough money loan providers concentrate much more on the worth of the residential or commercial property being utilized as security rather than the debtor's credit report, making them available to individuals with less-than-perfect credit rating

Advantages And Disadvantages of Hard Cash

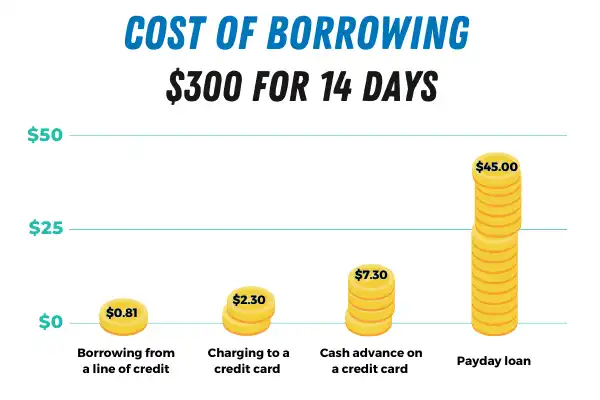

Nevertheless, there are drawbacks to take into consideration. Difficult cash fundings generally feature higher rate of interest contrasted to standard lendings, which can dramatically enhance the price of borrowing. In addition, the shorter financing terms connected with tough money finances may tax customers to settle the funding promptly, potentially impacting capital. It is crucial for individuals thinking about tough money fundings to consider these advantages and disadvantages very carefully prior to choosing.

Qualification and Application Process

To efficiently obtain a tough money finance, individuals have to meet certain eligibility requirements and browse a structured application procedure. Qualification for a hard cash lending mostly concentrates on the value of the building being made use of as collateral rather than the debtor's credit rating rating or economic history.

The application process for a tough cash car loan is usually more streamlined than standard financial institution lendings however still calls for thorough paperwork. Debtors can anticipate to give details such as home info, evidence of revenue, credit report, and a detailed introduction of the task. Lenders might additionally conduct appraisals and inspections to evaluate the home's worth and problem precisely. By satisfying these go to this website eligibility requirements and carefully completing the application process, individuals can enhance their chances of securing a hard cash loan for their realty endeavors.

Selecting the Right Hard Money Lending Institution

Having actually established the eligibility standards and application process for hard cash finances, the next crucial action in the loaning journey is determining one of the most appropriate hard cash loan provider for your real estate funding needs. When picking a tough money loan provider, it is vital to take into consideration a number of key factors to guarantee an effective loaning experience.

A loan provider with a tested track document of successful genuine estate investments and a positive reputation is a lot more likely to use trustworthy and efficient solutions. In addition, think about the lending institution's car loan terms, consisting of passion prices, loan-to-value ratios, and repayment schedules.

Moreover, evaluate the lending institution's adaptability and responsiveness. A good hard money lending institution must have the ability to deal with you to tailor a funding option that meets your details needs. Lastly, do not fail to remember to assess and contrast multiple lenders to ensure you are obtaining the best possible deal for your actual estate financial investment.

Tips for Effective Difficult Money Loaning

It is essential to clearly detail your project needs and financial requirements prior to approaching a difficult cash lender. Furthermore, it is advisable to research study and contrast numerous hard cash lending institutions to find one that lines up with your demands in terms of lending terms, rate of interest prices, and experience in your specific type of job.

An additional essential idea for effective tough money borrowing is to prepare a well-organized and detailed loan application bundle. This bundle must consist of information such as your project proposal, monetary statements, credit history, and any appropriate licenses her latest blog or licenses. Providing a full and specialist loan application will demonstrate your seriousness and preparedness to potential lenders, enhancing your integrity and chance of authorization. Last but not least, keeping open interaction and openness throughout the loaning procedure is vital to constructing a solid connection with your loan provider and making sure a smooth financing experience.

Final Thought

To conclude, tough money lendings supply a fast and flexible funding alternative for genuine estate investors, yet included greater rate of interest rates and much shorter terms. Recognizing the eligibility and application procedure, go right here in addition to choosing the appropriate loan provider, are essential action in successful tough money loaning. It is very important to consider the advantages and disadvantages meticulously before determining if a hard cash lending is the appropriate choice for your financial investment goals.

:max_bytes(150000):strip_icc()/Pay-Day-Loan-Personal-Loan-dfdeaa22f6ea4790b1c966fcd6c937cf.jpg)